washington state capital gains tax 2020

Capital gains is the most volatile tax source that any state has to forecast. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Washington state recently enacted a new capital gains tax set to begin January 1 2022.

. Capital Gains Tax Washington State 2020. During a tax panel at the Association of Washington. The new tax would affect an estimated 58000 taxpayers in the first.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. Capital Gains Tax Washington State 2020. Capital gains tax Washington Department of Revenue 4 days ago The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long.

Capital Gains Tax Washington State 2020 Entrebastidors August 4 days ago Mar 24 2022 The tax would equal 9 percent of your washington capital gains. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. It is not dependable or stable.

Essb 5096 violates the uniformity and limitation requirements of article vii sections 1 and 2 of the washington state constitution. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Washington has no gift tax so youll only be subject to the federal gift tax which says you can give up to 15000 to discrete individuals without any tax.

Essb 5096 violates the uniformity and limitation requirements of article vii sections 1 and 2 of the washington state constitution. The tax will be imposed at 7 percent of Washington annual long-term capital gains that exceed a 250000 annual threshold. Essb 5096 violates the uniformity and limitation requirements of article vii sections 1 and 2 of the washington state constitution.

Calculate the capital gains tax on a sale of real estate. Oct 02 2020 The 2021 unemployment tax hike is just the first in a multi-year forecast of substantially higher taxes on Washington. Washington state unemployment tax rate 2022.

Capital Gains Tax Washington State 2020. Married couples share a single deduction each spouses deduction is. From March 13 2020 to June 30 2022.

Washington does not have a typical individual income tax but does levy a 70 percent tax on capital gains income. The sale of stocks bonds and other high-value assets that earns more than 250000 will. The first 250000 in long-term gain is exempt from tax for each individual and married couple.

You will generally owe Washingtons capital gains tax on a sale of cryptocurrency if you hold it for more than one year and you are domiciled in Washington at the time the sale or exchange. Listing 11 Results Washington State Capital Gains Tax 2020 Total 11 Results Google Api Bing Api Capital gains tax Washington Department of Revenue 2 weeks ago The 2021 Washington. Washington Gift Tax.

Washington does not have a corporate income tax but does levy a gross. Includes short and long-term Federal and State Capital. The Washington Capital Gains Tax to Fund Education Initiative was not on the ballot in Washington as an Initiative to the Legislature a type of indirect initiated state statute.

Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less 40400 for. Washington state capital gains tax 2020 Sunday February 27 2022 Edit Lawsuits challenging Washingtons new state capital gains tax on the wealthy seek to re-rig our tax code. State estimates for who will pay the tax are under.

Faq Washington State Capital Gains Tax Brighton Jones Wealth Management

Coronavirus Shows Us Why Wa Has Always Needed An Income Tax Crosscut

Public Records Reveal Wa Dor S Thoughts On Capital Gains Income Taxes Washington State Wire

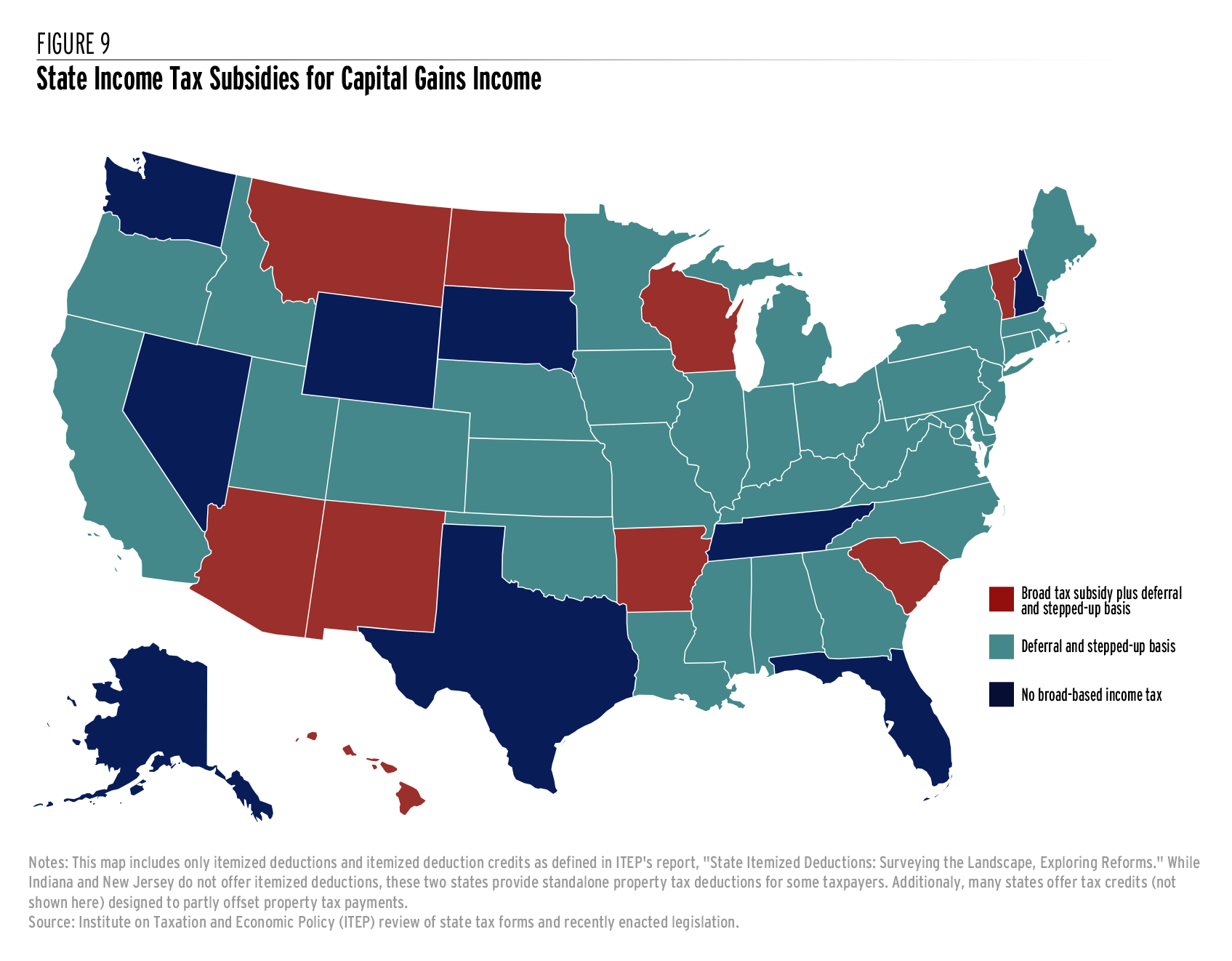

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Morning Wire 2020 Race For Governor Committee Days The Implications Of A Capital Gains Tax Washington State Wire

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Capital Gains Taxes Where Should You Sell Biglaw Investor

2021 Capital Gains Tax Rates By State

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

2021 Capital Gains Tax Rates By State

The Kind Of Change We Need Senate Oks Capital Gains Tax The Stand The Stand

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax In The United States Wikipedia

How Do State And Local Individual Income Taxes Work Tax Policy Center

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How T0 Avoid The Higher Capital Gains Taxes That Likely Are Coming