capital gains tax increase in 2021

75 basic 325 higher and 381 additional. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Managing Tax Rate Uncertainty Russell Investments

However it was struck down in March 2022.

. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. Yet for those with capital gains in lower income.

Basic rate payers and higheradditional rate payers. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Published 15 August 2021.

The tax hike would apply to households making more than 1 million. Capital gains tax increase 2021 uk Sunday February 27 2022 Edit. More than 80 percent of gains.

To summarize many of the OTS proposals did not pass however we can see there are some increases in tax for capital gains. By Charlie Bradley 0700 Thu Oct 28 2021. The dividend tax rates for 202122 tax year are.

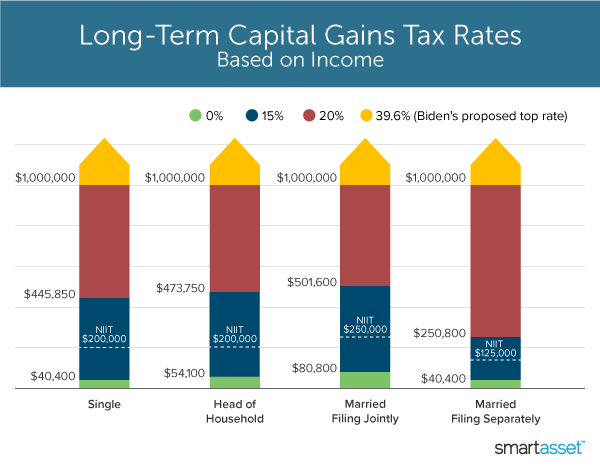

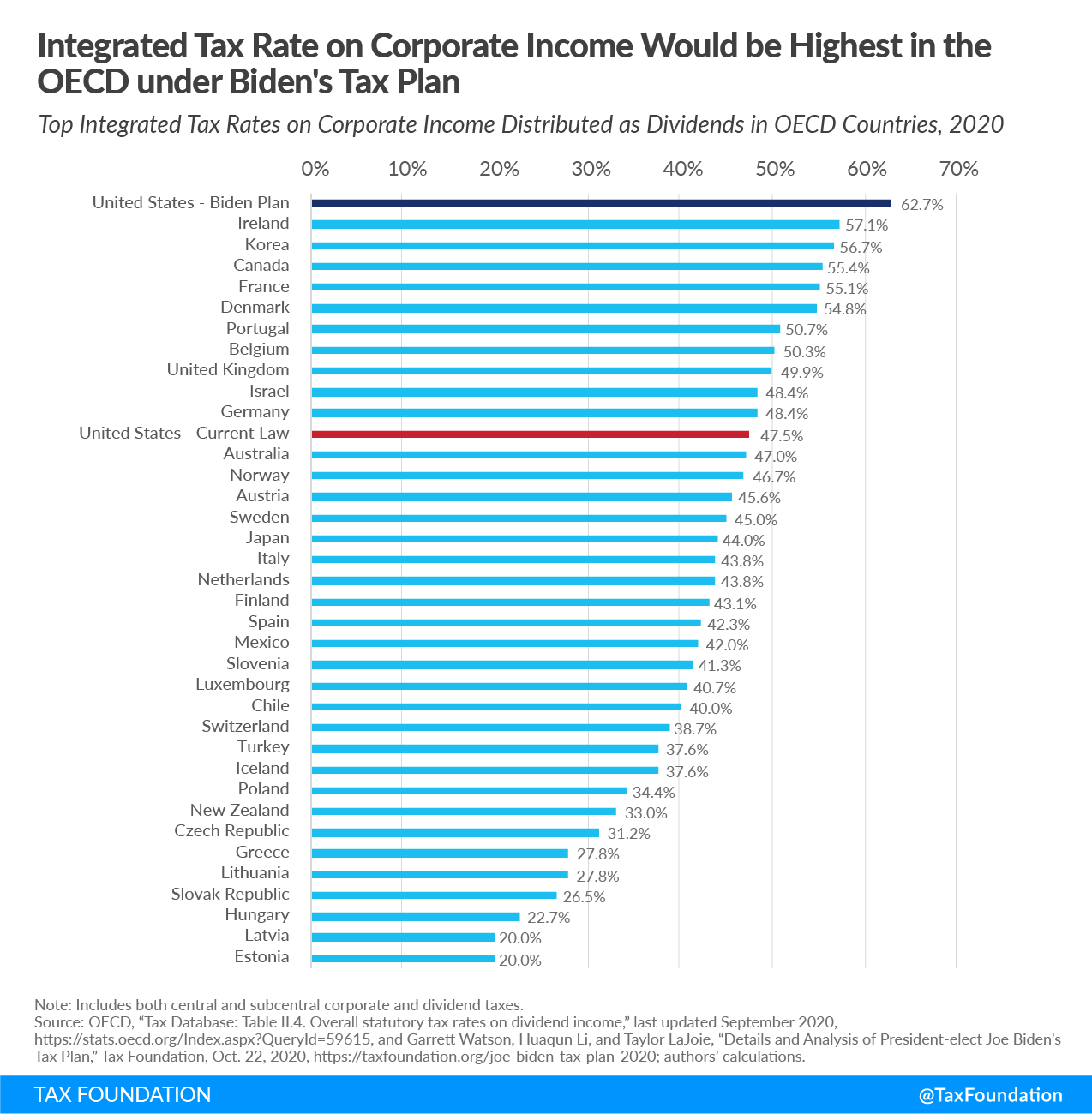

Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase. The top rate would jump to 396 from 20. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Will capital gains tax go up in 2021. Of the total 546 percent was declared by taxpayers with incomes over 250000.

The effective date for this increase would be September 13 2021. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe.

House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued. The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

What is the dividend tax rate for 2021. President Biden will propose a capital gains tax increase for households making more than 1 million per year. CGT rates differ from income tax rates and are in two broad brackets.

4 rows Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. The bank said razor-thin majorities in the House and Senate would make a big.

Over the 20202021 tax year the basic rate on. Moreover such a tax hike wouldnt even accomplish the desired goal of increasing revenue. In all Canadians realized 729 billion in taxable capital gains.

How Could Changing Capital Gains Taxes Raise More Revenue

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

How Progressive Taxes Work In The United States Explained

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

2019 2021 Capital Gains Tax Rates Go Curry Cracker

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

How Do Cryptocurrency Taxes Work Avier Wealth Advisors

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

State Taxes On Capital Gains Center On Budget And Policy Priorities